Form 4562 depreciation calculator

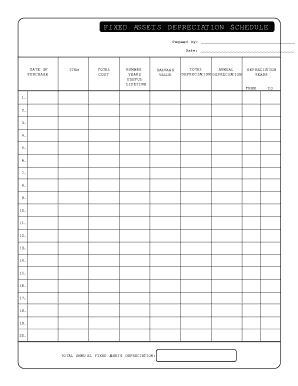

203 mm 8 3 279 mm 11. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation.

![]()

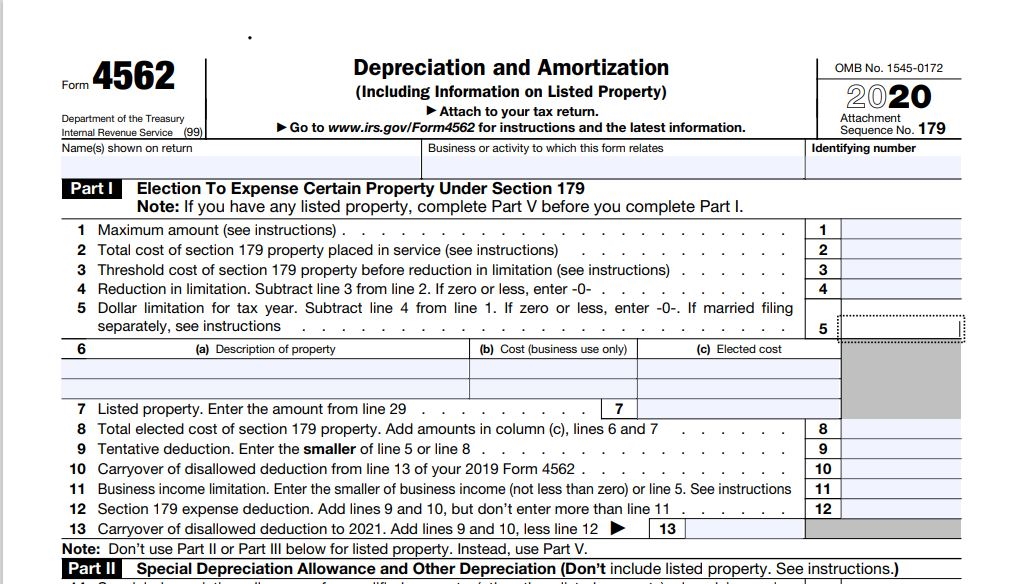

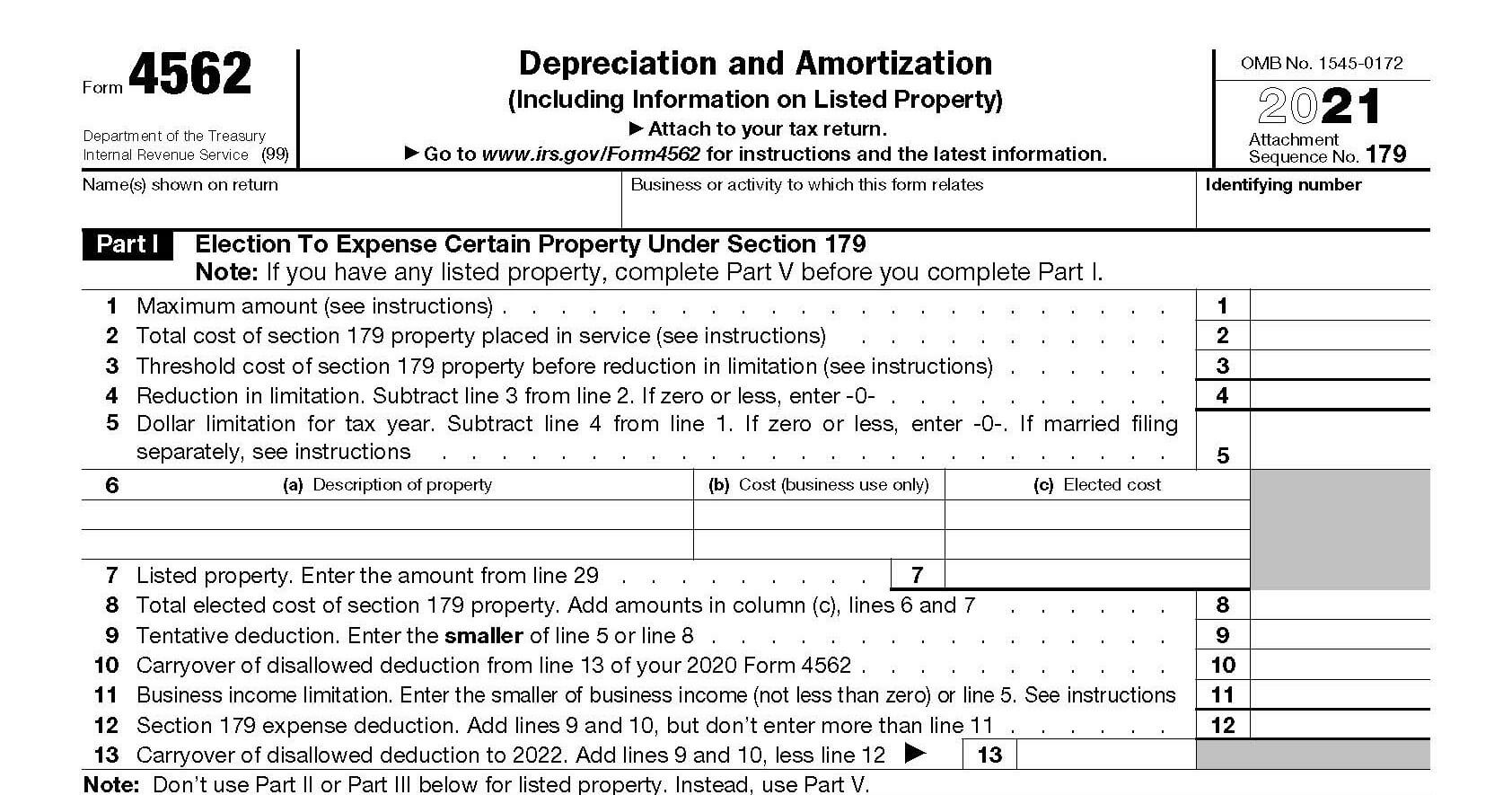

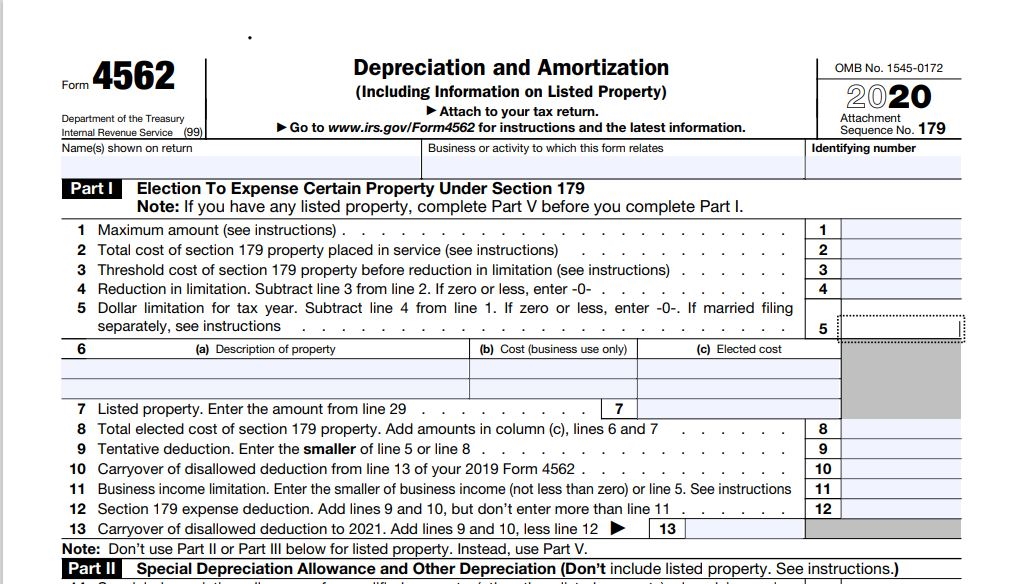

Form 4562 Do I Need To File Form 4562 With Instructions

Depreciation 4562 is an extremely efficient way to calculate Federal Tax Depreciation.

. If you are filing Form 990-PF Return of Private Foundation or Section 4947 a 1 Trust Treated as Private Foundation attach a schedule containing depreciation information instead of Form. Real Estate Property Depreciation Calculator Calculate. IRS Form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property.

A tax form distributed by the Internal Revenue Service IRS and used to claim deductions for the depreciation or amortization of a. Section CAssets Placed in Service During 2021 Tax Year Using the Alternative Depreciation System Form 4562 Department of the Treasury. Open the clients return.

Form 4562 is required if you are using actual expenses and are depreciating the vehicle andor claiming a Section 179 deduction. HEAD TO HEAD PAPER. Use of the Depreciation Module to calculate depreciation Section 179 deduction and bonus depreciation and the actual vehicle expenses that can be deducted based on mileage is.

Form 4562 is computed with a minimum amount of input. Although the description for Line 11 of Form 4562 Depreciation and Amortization is Business income limitation the calculation for this line is not strictly based on your business income. Type DEO to highlight the.

Press F6 on your keyboard to open the Open Forms window. Carryover of disallowed deduction from line. FORM 4562 PAGE 1 of 2 MARGINS.

If you are filing Form 990-PF Return of Private Foundation or Section 4947a1 Trust Treated as Private Foundation attach a schedule containing depreciation information instead of Form. Follow these steps to enter section 179 information on Form 4562. If you are using the depreciation module in TaxSlayer Pro.

Prior Depreciation 54167 Current Depreciation 8766 Form 4562 Depreciation and Amortization Report for Tax Year 2021 Prior Depreciation 61484 54167 8766 61484. TOP 13 mm 1 2 CENTER SIDES. This is an idea tool for a tax professional CPA.

Sz1znxdfmlybgm

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Gain An Understanding On The Key Concepts You Should Be Considering When Estate Planning For A Dual Estate Planning Continuing Education Professional Education

How To Complete Irs Form 4562

16 Printable Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

16 Printable Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Macrs Depreciation Calculator For Excel

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Form 4562 Depreciation Guru

Macrs Depreciation Calculator Irs Publication 946

2020 Form 4562 Depreciation And Amortization 5 Nina S Soap

Learn How To Fill The Form 4562 Depreciation And Amortization Youtube

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Calculator Irs Publication 946

Form 4562 Do I Need To File Form 4562 With Instructions

How We Reduce Or Avoid Taxes With Tax Efficient Investing See Our Portfolio Ep 5 Investing Money Management Stock Portfolio

![]()

Form 4562 Do I Need To File Form 4562 With Instructions